The 15 year roof insurance rule is transforming how homeowners maintain coverage. Insurance companies now routinely drop homeowners with roofs over 15 years old—or switch them from full replacement cost to depreciated value coverage. This industry-wide shift is driven by $31 billion in roof-related claims nationwide in 2024 alone, with Colorado ranking second nationally for hail damage. For homeowners approaching this threshold, understanding the 15 year roof insurance rule and acting proactively can mean the difference between maintaining affordable coverage and facing the expensive last-resort FAIR Plan.

Does Colorado Have a 15-Year Roof Protection Law?

No. Colorado has no equivalent to Florida Statute 627.7011(5), which prohibits insurers from denying coverage solely based on roof age for roofs under 15 years old. Florida’s law also requires insurers to accept inspection reports showing 5+ years of remaining useful life for older roofs.

In Colorado, insurers maintain complete discretion to:

- Set their own roof age thresholds (commonly 10, 15, or 20 years)

- Refuse coverage based solely on roof age

- Decide whether to accept roof certifications or inspections

- Switch coverage from RCV to ACV at any age threshold

While Colorado’s HB 23-1174 extended non-renewal notice periods to 60 days and HB 25-1302 created grant programs for resilient roof upgrades, neither law restricts insurers’ ability to deny or non-renew policies based on roof age. Colorado homeowners must work within the voluntary market or resort to the state’s FAIR Plan if standard insurers refuse coverage.

This regulatory gap makes proactive roof documentation, maintenance, and strategic upgrades even more essential for Colorado Springs homeowners.

What the 15-year roof insurance rule actually means

The “15-year roof restriction” isn’t a single policy but rather a cluster of insurance industry practices that fundamentally change how your roof is covered once it reaches a certain age. The consequences vary by insurer but typically include three major changes.

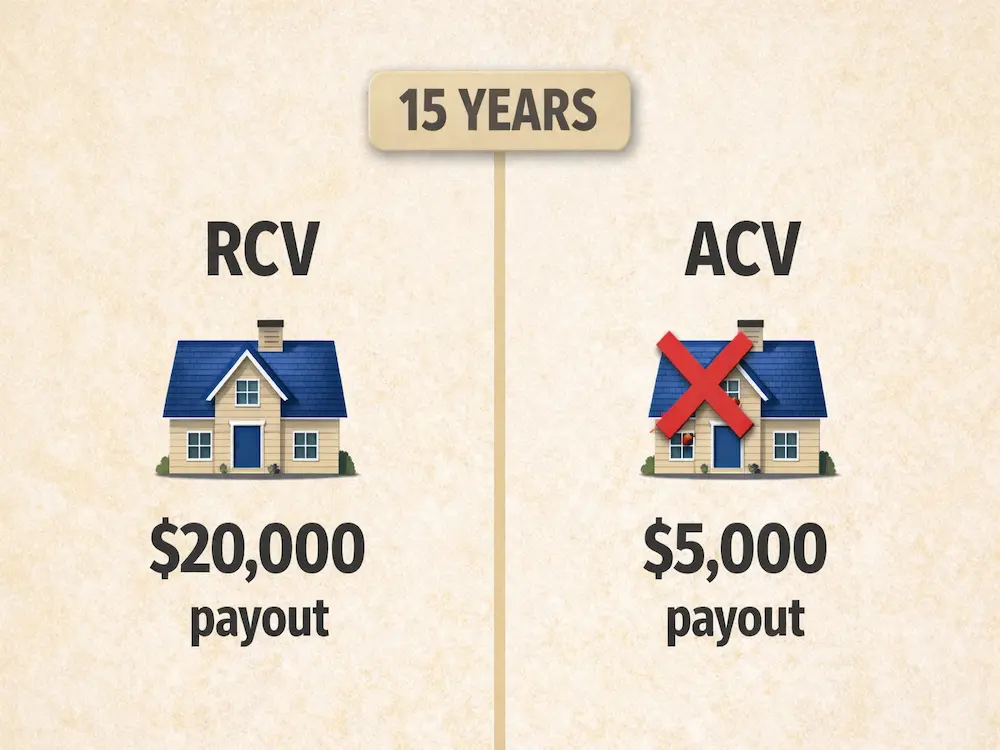

Coverage type downgrade is the most common impact. Insurers switch from Replacement Cost Value (RCV), which pays the full cost to replace your roof with comparable new materials, to Actual Cash Value (ACV), which deducts depreciation. For a 15-year-old roof with a $20,000 replacement cost, ACV coverage might pay only $5,000 after depreciation—leaving homeowners to cover 70-75% out of pocket.

Roof Payment Schedules represent an increasingly common mechanism where insurers assign predetermined percentage payouts based on roof age: 100% for new roofs, declining to roughly 60% at 11-15 years, 40% at 16-20 years, and just 20% beyond 20 years. These schedules effectively reduce payouts while maintaining the appearance of replacement coverage.

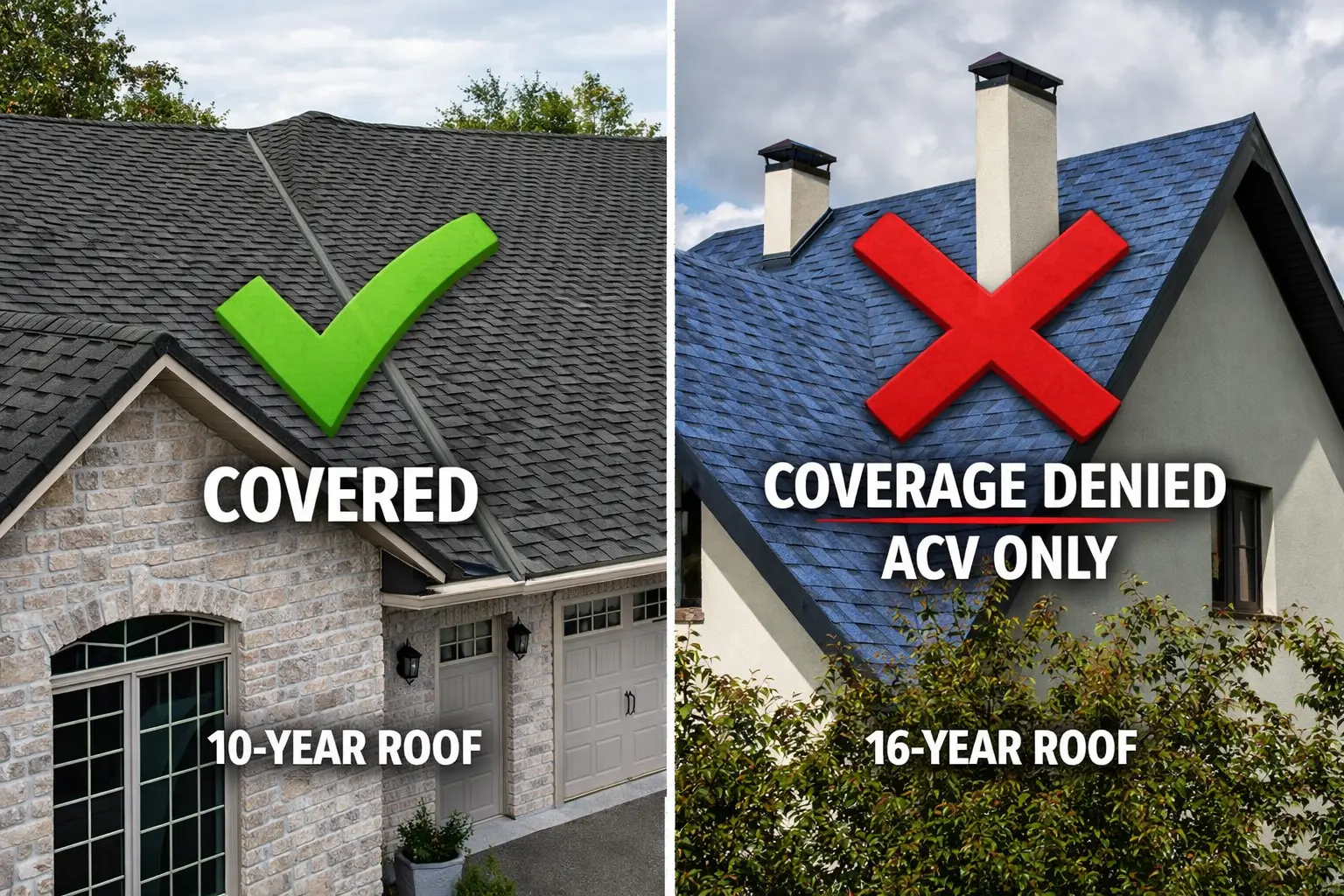

Non-renewal or policy denial hits hardest. Many carriers simply refuse to renew policies or write new coverage for homes with roofs exceeding 15-20 years. In Colorado’s hail-prone market, some insurers draw the line at just 10 years for asphalt shingles.

Major carriers enforce varying age thresholds

Each insurance company maintains distinct roof age policies, and understanding these differences is crucial for Colorado Springs homeowners shopping for coverage.

Allstate pioneered restrictive roof policies with its “House & Home” program, launched in 2011. Roofs over 10 years old receive only ACV coverage for wind and hail claims, United Policyholders with coverage dropping to approximately 60% of replacement cost at 10 years and 20% by age 25. Insurance Forums Their optional Roof Surfaces Extended Coverage endorsement—available only for roofs under 15 years—restores full replacement value.

State Farm uses a 1-4 rating system for roof condition. Ratings of 1-2 qualify for discounts; a rating of 3 means higher premiums; rating 4 triggers coverage restrictions or repair requirements. Roofs 15-20 years old at policy inception may receive only ACV coverage, and in hail-prone states like Colorado, State Farm offers ACV-only endorsements for roofs over 10 years.

Nationwide mandates its Limited Roof Endorsement for roofs (other than slate, tile, or metal) exceeding 11 years in some states. This endorsement pays a preset percentage on wind and hail claims that decreases with age.

Farmers Insurance requires inspections of roofs over 15-20 years before renewal and may refuse to renew unless repairs or replacement are completed. Pro-rated coverage for shingle roofs is standard practice.

Citizens Property Insurance (Florida’s insurer of last resort) offers instructive thresholds other states may eventually adopt: 25 years for shingle roofs and 50 years for tile, slate, or metal. However, a roof must demonstrate at least 5 years of remaining useful life via professional inspection.

| Carrier | Primary Age Threshold | What Happens |

|---|---|---|

| Allstate | 10 years | Switches to ACV; 60% coverage at 10 years |

| State Farm | 15-20 years | ACV-only coverage; rating system applies |

| Nationwide | 11 years | Limited Roof Endorsement required |

| Farmers | 15-20 years | Inspection required; may require replacement |

| Progressive | Varies by underwriter | Full replacement may be required |

| American Family | Age-based eligibility | Base policy is ACV; RCV available by age |

Colorado faces unique challenges from hail exposure

Colorado’s position in “Hail Alley” drives some of the nation’s strictest roof underwriting. The state ranks second nationally for hail-related insurance claims, with hail accounting for 55-70% of homeowners insurance costs statewide. Over $3 billion in hail damage has occurred in Colorado and Wyoming over the past decade, and 30% of home insurance premiums now fund roof-related claims.

This exposure shapes how insurers treat Colorado roofs. In hail-prone areas, average roof lifespan drops to approximately 15 years compared to 22 years in western states. Many Colorado insurers impose a “10-Year Rule,” switching coverage from RCV to ACV at 10, 15, or 20 years depending on the carrier. Percentage deductibles (1-2% of dwelling coverage) have become standard, meaning a 1% deductible on a $600,000 home equals $6,000 out-of-pocket before coverage begins.

Recent Colorado legislation provides some relief. HB 23-1174 now requires insurers to give 60 days written notice before non-renewal (up from 30) and mandates that insurers accept contractor estimates when establishing replacement costs. More significantly, HB 25-1302 (the Strengthen Homes Enterprise Act) creates a grant program for homeowners upgrading to resilient roof systems, with approximately $6.5 million available in fiscal year 2025-26, growing to $13 million annually. These grants can help fund impact-resistant roofing upgrades that qualify for insurance discounts.

Colorado’s FAIR Plan launched in April 2025 as a safety net, though it remains a true last resort with high premiums and limited coverage. Only 51 homeowners purchased coverage in its first months of operation.

Industry trends point toward stricter requirements through 2026

The roof age restriction trend is accelerating, not retreating. According to Verisk’s April 2025 report, roof repair and replacement costs reached nearly $31 billion in 2024—up 30% since 2022. Roof-related line items now comprise more than 25% of all residential claim value. verisk

The premium gap by roof age has widened dramatically. The difference between premiums for roofs under 5 years old versus 11-15 years old expanded from $49 in 2022 to $155 in 2025— 216% increase. Average deductibles rose 22% in 2025 following a 15% increase in 2024.

Insurers increasingly rely on technology—aerial imagery, AI analysis, drones, and satellite imaging—to assess roof condition without physical inspections. This capability enables more granular, property-specific risk pricing and faster identification of roofs that fail underwriting criteria.

For 2026, industry analysts project continued premium growth (though slowing to approximately 3%), further deductible increases, and persistent roof age scrutiny as a primary underwriting factor. The surplus lines market will continue serving high-risk properties, with these policies already accounting for 17% of coverage in California, Florida, and Texas—up from under 2% in 2023.

Practical options for homeowners facing restrictions

Colorado Springs homeowners have multiple strategies available before, during, and after facing roof-related coverage challenges.

Before reaching 15 years, proactive documentation is essential. Maintain complete records of all roof repairs, inspections, and warranties with before-and-after photos. Schedule annual inspections by licensed contractors—especially after significant hail or wind events—and obtain written reports with photos. Review your policy’s Declarations Page to understand whether you currently have RCV or ACV coverage and what deductibles apply.

When facing non-renewal, shop aggressively through independent insurance agents who represent multiple carriers. Each insurer has different roof age thresholds, and a denial from one doesn’t guarantee denial from all. Ask agents specifically: “What is your carrier’s roof age limit for RCV coverage?” and “Can I get coverage with a roof certification/inspection?”

A roof certification differs from a standard inspection by providing a professional opinion letter on remaining useful life, confirming the roof is leak-free and defect-free. Many insurers accept coverage applications if the roof has at least 3-5 years of documented remaining useful life. Certifications typically cost $200-400 and are valid for 2-5 years.

Surplus lines insurance offers legitimate coverage for risks standard insurers won’t accept. Available through licensed surplus lines brokers in Colorado, these policies aren’t required to have rates approved by the Division of Insurance. A 3% premium tax applies, and these policies aren’t protected by Colorado’s Guaranty Fund if the insurer becomes insolvent—but they provide coverage when conventional options evaporate.

Impact-resistant roofing represents perhaps the strongest long-term solution. Class 4 impact-resistant shingles (rated under UL 2218) can earn 20-35% premium discounts in Colorado. For a typical 2,500 square foot Colorado Springs home, upgrading adds $1,000-2,000 to replacement cost but generates annual insurance savings of $400-700, producing full return on investment within 2-4 years. Watch for the Strengthen Homes Enterprise grants launching in 2026 that may help fund these upgrades.

Warning signs your coverage is at risk

Several indicators suggest potential non-renewal is approaching: receiving requests for roof inspection at renewal; your policy switching from RCV to ACV on roof coverage; deductible increases at renewal; significant premium increases above market average; or notices of coverage changes buried in renewal documents.

Read renewal packets carefully—coverage changes often appear in fine print.

If facing denial or non-renewal, request reconsideration in writing and ask for the specific reason. Provide additional documentation including inspection reports, repair records, and photos. Request a re-inspection by a different adjuster if the initial assessment seems unfair.

Colorado’s Division of Insurance accepts consumer complaints at 303-894-7490 or online at doi.colorado.gov. The DOI recovered $17.6 million for Colorado consumers in fiscal year 2023-24—filing a complaint can produce results.

Conclusion

The 15-year roof restriction reflects a fundamental shift in how insurers evaluate and price risk, driven by soaring claim costs and climate-related damage. Colorado Springs homeowners face this reality more acutely than most due to the region’s intense hail exposure. However, preparation transforms this challenge from crisis to manageable planning decision. Document your roof’s condition now, explore impact-resistant upgrades before replacement becomes urgent, and work with independent agents who understand Colorado’s market. The homeowners who fare best will be those who act before reaching age thresholds—not those scrambling to find coverage after receiving a non-renewal notice.

Before you accept a denial or ACV -only payout, get the damage documented correctly.

Insurance companies often use roof age as a shortcut to pay less. I document real storm damage and help homeowners get approved when coverage should apply.