Don’t Let Your Insurance Company Shortchange Your Roof Claim

Professional Roof Inspection & Insurance Claim Documentation in Colorado Springs

I’ve worked with State Farm, Allstate, USAA, and every major carrier operating in Colorado Springs. I know what they approve, what they deny, and how to document claims they can’t dispute.

Independent roof consulting and insurance claim advocacy for homeowners who want expert guidance—not contractor sales pressure.

Why Colorado Springs Homeowners Need Expert Advocacy

Insurance adjusters handle thousands of claims every year. You’re handling one or two in your lifetime. That experience gap costs homeowners an average of $3,000-$8,000 in missed coverage.

Older Roofs Face Scrutiny

Carriers are implementing 10-15 year restrictions, depreciated coverage, or refusing renewals entirely.

Claims Get Minimized

Even with legitimate damage, adjusters cite “wear and tear” or “cosmetic damage” to reduce payouts.

Code Compliance Gets Ignored

Insurance estimates often exclude $3,000-$8,000 in required Pikes Peak Regional Building Department upgrades.

“Free” Inspections Create Conflicts

Contractors offering free inspections are trying to win your repair contract—their documentation serves their sales goals, not your claim.

100+ Reviews

How I Help You Win

I Know Your Carrier’s Playbook

State Farm’s tactics differ from Allstate’s. USAA’s strategies differ from Farmers’. After working with every major carrier for over a decade, I know:

- What each carrier approves and denies

- Which adjusters work your area

- How to document claims they can’t dispute

- Carrier-specific denial patterns and how to counter them

I Document Code Compliance Upfront

Your replacement must meet current Pikes Peak Regional Building Department codes—not the codes from 15 years ago. I document required upgrades in your initial claim so you avoid surprise costs.

Common requirements insurance excludes:

- Wind uplift specs for Colorado Springs wind zones

- Enhanced ice and water shield

- Modern flashing and ventilation

- Code compliant sheathing

No Contractor Bias, No Sales Pressure

I don’t install roofs or sell materials. I inspect damage, document claims properly, and connect you with contractors I’ve vetted.

My partnerships with contractors allow me to provide consulting at no upfront cost while maintaining my role as YOUR advocate.

What this means:

- Unbiased assessment (no repair contract to win)

- Professional expertise without upfront fees

- Vetted contractors who meet my standards

- You only pay your insurance deductible

Ready to Document Your Claim Right?

Join hundreds of Colorado Springs homeowners who got fair settlements with expert documentation.

Call or Text Me

(719) 210-8699my Process

5 Clear Steps

Complete 21-point roof inspection with professional photo documentation, weather verification, and carrier-specific guidance.

Professional Post-Storm Inspection

Complete 21-point roof assessment with professional photo documentation, weather verification, and carrier-specific guidance.

Detailed report showing damage, code requirements, and realistic claim expectations based on YOUR specific carrier.

$0 upfront. My contractor partnerships cover this.

Pre-Claim Strategy Session

Review your policy, discuss your carrier’s claim tactics, and prepare you for their adjuster.

Carrier-specific playbook and documentation strategy.

Adjuster Meeting Support

I attend your insurance inspection, point out damage using methods they can’t dismiss, and ensure code requirements are acknowledged.

Level playing field with someone who knows the adjusters.

Settlement Review & Analysis

Evaluate if the estimate covers all damage plus required code upgrades. Guide your next steps.

Expert assessment of fair vs. lowball offers.

Escalation Support (If Needed)

If denied or undervalued, I connect you with public adjusters or attorneys who specialize in your carrier.

Roadmap for fighting back.

What Colorado Springs Homeowners Say

“The roof consultant, Mr. Gerald Winik, is a Rock Star. His professionalism, communications, expertise, and commitment to ensure everything was done to the ultimate level of perfection were simply breathtaking.”

— AW, Colorado Springs

“Gerald was awesome communicating with us and was instrumental in helping us through the process.”

— S M, Broadmoor

“Gerald kept me in the loop from start to finish. Interactions with everyone—from field crew to office staff—were 5 stars.”

— L M, Colorado Springs

Who This Is For

You’re dealing with:

- A “challenging” carrier (State Farm, Allstate, USAA)

- A roof that’s 10+ years old

- Concerns about age restrictions or depreciation

- Desire for unbiased documentation before filing

- Problems with past claims you want to avoid

- Need for code compliance expertise

You value:

- Experienced advocacy over “free” services with conflicts

- Professional documentation over contractor sales pitches

- Honest assessment over inflated damage claims

What You Pay: Clear, Transparent

My Services Cost You Nothing Out of Pocket

Your only expense is your insurance deductible when repairs are completed—typically $500 to $2,500 depending on your policy type.

How this works:

I’ve built partnerships with contractors I’ve carefully vetted. This model allows me to provide professional consulting at no upfront cost while ensuring you work with quality contractors.

What this means for you:

- No conflicts of interest from contractors chasing repair bids

- Professional expertise without consultation fees

- Vetted contractors who handle claims properly

- Clear expectations—you’ll know your deductible upfront

The real value:

If my carrier-specific documentation recovers even $2,000-$5,000 more than you’d get otherwise, you’ve gained thousands while only paying your standard deductible.

More importantly, you avoid the $3,000-$8,000 surprises from missed code requirements.

Colorado Springs Homeowner Resources

Essential guidance for navigating insurance claims

What to Do Immediately After a Hailstorm

Step-by-step action plan for documentation and timing

The 15-Year Roof Restriction Explained

What’s changing and how to protect yourself

How Insurance Adjusters Evaluate Damage

What’s changing and how to protect yourself

Professional vs. “Free” Contractor Inspections

Why conflicts of interest matter

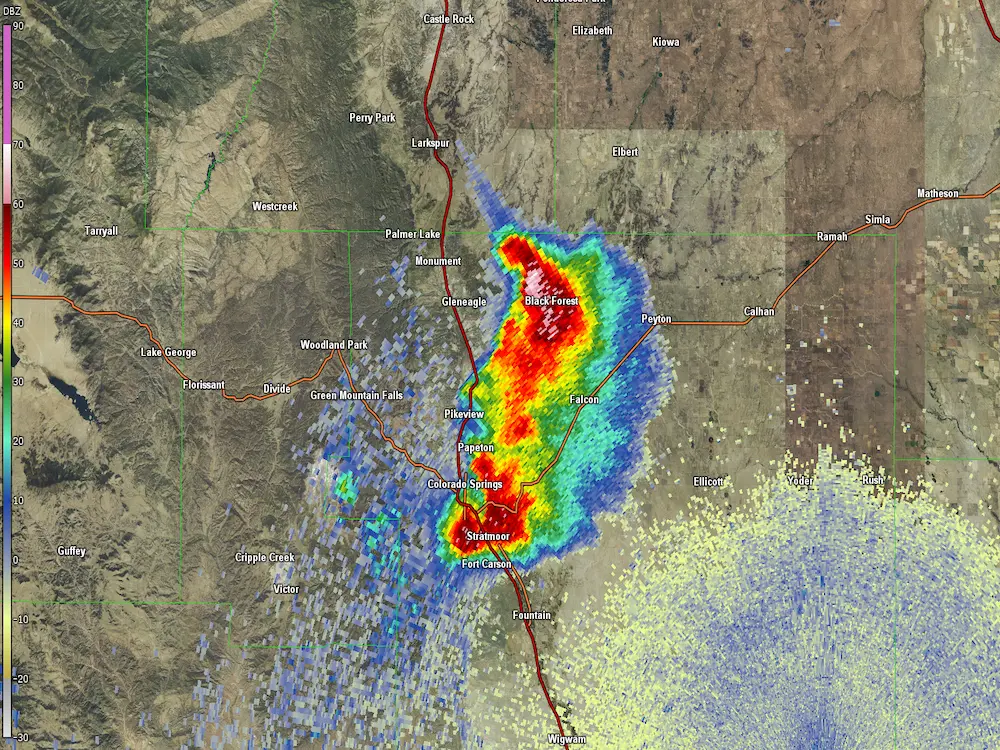

Serving Colorado Springs & The Front Range

Colorado Springs · Monument · Fountain · Manitou Springs · Security-Widefield · Falcon · Woodmoor · Black Forest · Briargate · Northgate

Located elsewhere? Contact me—I may be able to help or refer you to a trusted consultant.

Still Have Questions About Your Roof or Insurance Claim?

The best way to get answers specific to YOUR situation is a free, no-obligation inspection. I’ll assess your roof, explain your options, and give you an honest evaluation—even if that means telling you NOT to file a claim.

- No contractor sales pitch—just honest expertise

- Free inspection with written report and photos

- Carrier-specific guidance for YOUR insurance company

Call or Text Me

(719) 210-8699